Managing your finances effectively is essential for achieving financial stability and security. With the advancement of technology and changing economic trends, it is important to stay updated on the latest budgeting techniques to improve your financial health in 2025.

1. Create a Budget

Start by creating a detailed budget that outlines your monthly income and expenses. This will help you track where your money is going and identify areas where you can cut back on unnecessary spending.

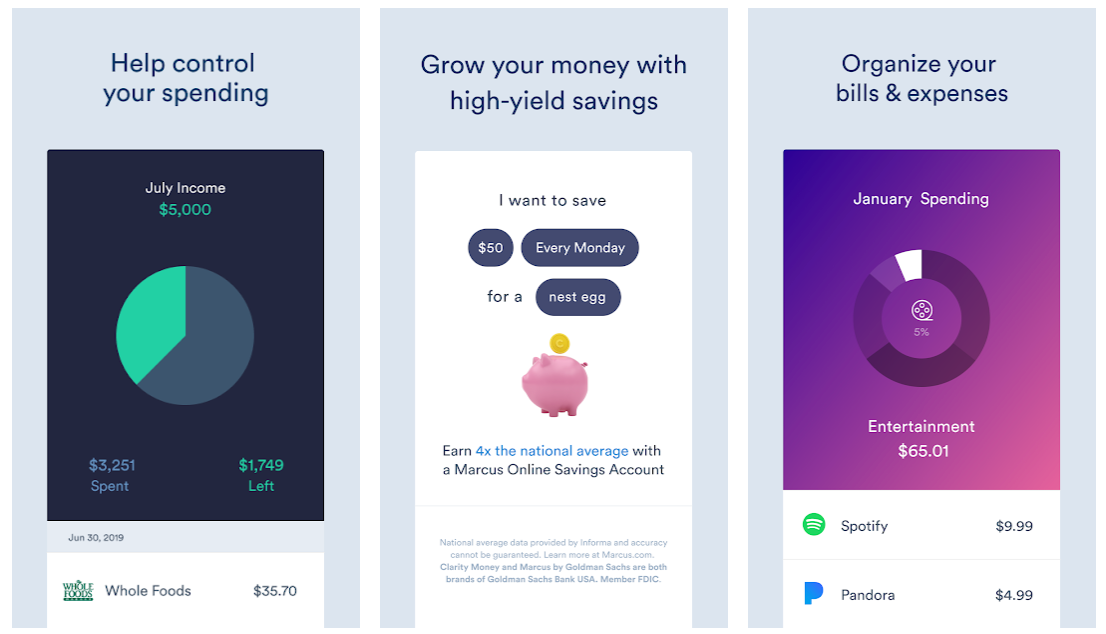

2. Use Budgeting Apps

Take advantage of budgeting apps that can help you track your expenses, set financial goals, and monitor your progress. These apps can provide valuable insights into your spending habits and help you make informed financial decisions.

3. Set Realistic Goals

Establish clear financial goals for yourself, such as saving for a new home, paying off debt, or building an emergency fund. Set achievable targets and create a plan to reach them within a specified timeframe.

4. Automate Your Savings

Automate your savings by setting up automatic transfers from your checking account to your savings account or investment portfolio. This will help you save consistently without having to think about it.

5. Cut Back on Non-Essential Expenses

Identify non-essential expenses in your budget, such as dining out, shopping for unnecessary items, or subscription services you no longer use. Cut back on these expenses to free up more money for savings and investments.

6. Monitor Your Credit Score

Regularly check your credit score and report to ensure there are no errors or fraudulent activities that could negatively impact your financial health. A good credit score can help you qualify for better loan terms and lower interest rates.

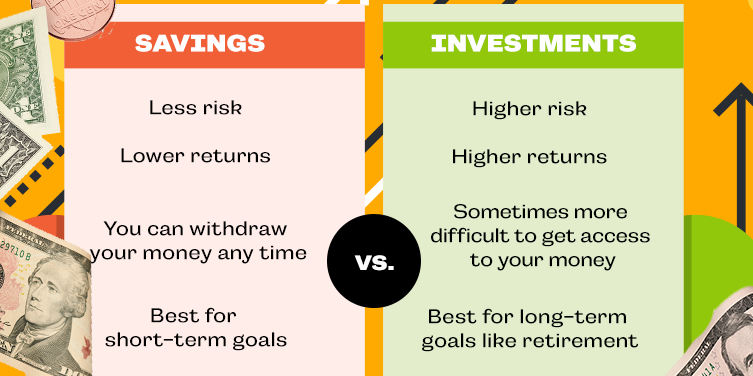

7. Diversify Your Income

Explore ways to diversify your income sources, such as investing in stocks, real estate, or starting a side business. This can help you generate additional revenue streams and reduce your reliance on a single source of income.

8. Review Your Insurance Policies

Review your insurance policies, including health, auto, home, and life insurance, to ensure you have adequate coverage at an affordable price. Consider bundling policies or shopping around for better rates to save money on premiums.

9. Track Your Progress

Regularly review your budget, track your progress towards your financial goals, and make adjustments as needed. Celebrate your achievements and learn from any setbacks to continue improving your financial situation.

10. Seek Professional Advice

If you need help managing your finances or navigating complex financial decisions, consider seeking advice from a financial advisor or planner. They can provide personalized guidance and recommendations tailored to your specific needs and goals.

Conclusion

By implementing these smart budgeting tips in 2025, you can take control of your finances, save more money, and achieve your financial goals. Stay proactive, stay informed, and stay motivated to secure a bright financial future for yourself and your loved ones.