Retirement may seem like a far-off dream for some, but it’s never too early to start planning for the future. Whether you’re in your 20s, 30s, 40s, or beyond, taking steps to prepare for retirement can help ensure a comfortable and secure future.

Setting Retirement Goals

The first step in planning for retirement is to set clear goals. Determine what age you would like to retire, how much money you will need to live comfortably, and what lifestyle you envision for your golden years. Having specific goals in mind will help you create a realistic plan for achieving them.

Creating a Retirement Savings Plan

Once you have your goals in place, it’s time to start saving for retirement. If your employer offers a retirement savings plan, such as a 401(k) or IRA, take advantage of it. Contribute as much as you can afford, and consider increasing your contributions as your income grows.

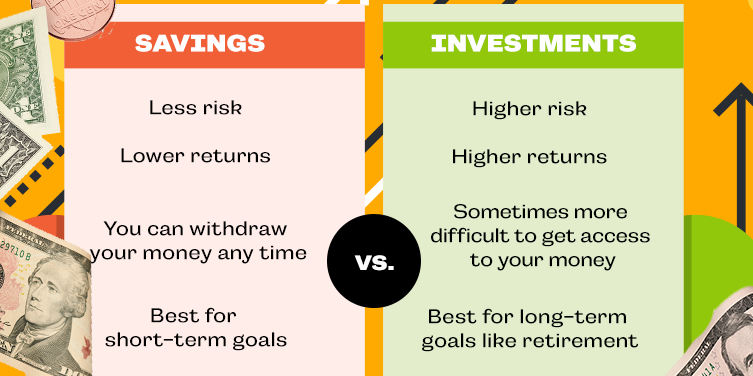

Investing for the Future

Investing can be a powerful tool for growing your retirement savings. Consider working with a financial advisor to develop an investment strategy that aligns with your goals and risk tolerance. Diversifying your investments can help protect your savings from market fluctuations.

Managing Debt and Expenses

One of the biggest obstacles to retirement savings is debt. Make a plan to pay off high-interest debt, such as credit cards and personal loans, as quickly as possible. Cutting unnecessary expenses can also free up extra money to put towards retirement savings.

Adjusting Your Plan as You Age

As you move through different stages of life, your retirement plan should evolve with you. Review your goals and financial situation regularly, and make adjustments as needed. For example, as you get closer to retirement age, you may want to shift your investments to more conservative options to protect your savings.

Seeking Professional Advice

Planning for retirement can be complex, and it’s okay to seek help from a professional. A financial advisor can provide guidance on how to optimize your retirement savings and create a plan that meets your unique needs and goals.

Start Planning for Retirement Today

Regardless of your age, it’s never too early or too late to start planning for retirement. By setting clear goals, creating a savings plan, investing wisely, managing debt, and seeking professional advice, you can take control of your financial future and enjoy a comfortable retirement.